Professional design services are all too often chosen and judged by their prices. Good design is commoditized, expected, presumed. So in many situations, design professionals must resort to bidding. The problem with bidding is that you must provide the lowest price to get the job. This, in turn, lowers your profit margin and your ability to provide superior service.

Inevitably bidding results in arguments over final fees, payments, and work quality, especially since final design fees typically run about 25 percent over the estimated cost. The sidebar details six clear reasons why bidding is not in the client’s best interest. Perhaps most importantly, it stifles creativity and innovation. The client is practically guaranteed a journeyman design that does the job—no more.

Bidding as a process is okay if as the client’s only criterion is not price. The client must also take into account scope of services, charges for extras and changes, reimbursable markups, and so on. A two-envelope bid system may help, whereby one envelope contains the scope and another the price. A client then narrows down the choices to perhaps five proposals on the basis of scope and design criteria, and then makes a judgment on price.

Barring that, suggest a negotiated bid situation, whereby the firm with the lowest bid is chosen but the final price is negotiated. In this way, the client can obtain a price that is sure to encompass the entire project scope.

Why Bidding is Not in the Client’s Best Interest:

1. If price is the only selection criterion, the A/E may underbid and gain on changes anyway.

2. The atmosphere may not be mutually beneficial, since bidding implies cost cutting.

3. Clients may be unwilling to discuss scope changes because they have a specified price in mind; this may be true even when the scope changes could save money in the long run or greatly enhance the functionality of the structure.

4. Bidding is all too often a win-lose situation, with either one or the other ending up the loser. Negotiating a win-win strategy is better for both sides.

5. All too often, municipal bidding situations are decided by citizens who do not understand the nature of design work and the impact of bidding on the professional’s efforts.

6. All design professionals in a competitive bid situation are told to bid only on what they see. They are not motivated to suggest better ideas, materials, or methods.

Of course, the ideal situation is to avoid being asked to bid at all. You achieve that by positioning your firm above the rest; and you achieve that positioning by creating new products or services that are perceived to be so unique that your firm is worth the extra charge. If the service you offer is perceived by your clients to be in demand, then they’ll pay any price for it. Consider today’s demand for sustainable design.

How do you position your firm so that it is so valuable to the clients that they’ll pay you virtually anything to perform?

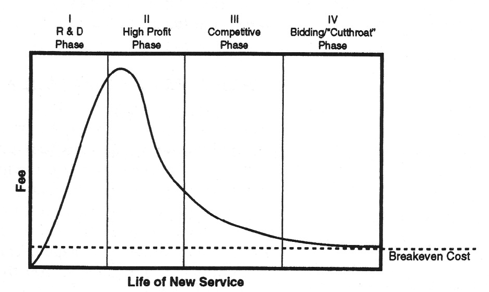

As Frank Stasiowski explains in detail in his book, The Value Pricing Imperative for Design Firms, the answer is in research and development of future client needs. Create new services and you can price them at any level. In manufacturing, this is known as being first to market, which occurs early in the product lifecycle (see graph below). The value of being first to market is simple: A brand new product without competition, which is needed or wanted by a large group of consumers, will sell at any price. As the product ages, the greater becomes the competition and the less you can raise or sustain higher prices. (This is when bidding wars occur.) Consider how expensive a much-in-demand medication is when a company like Novartis or Pfizer is the only provider; then how quickly that price plummets when the patent expires and generics become available.

Architectural and engineering services are what we sell. Our services have been provided for centuries, else there would be no Colosseum, no Parthenon, no Winchester Abbey. In recent centuries as we have standardized our approach to providing services, we have begun to blend together. Traditional architectural and engineering services are perceived as a commodity, an old service. Create the perception of a new service, and you will be perceived as more valuable.

Stage 1: Research and Development

Stage 1: Research and Development

This graph represents the lifecycle of a product or service as it is developed, enters the market, and becomes competitive. The difference between the break-even line on the price scale and the revenue-flow curve represents a firm’s level of profitability. The first phase in the price lifecycle is the research and development phase, Phase I in this graph. As can be seen, this phase costs firm money, and represents a loss because it does not produce any income—yet. The price lifecycle curve on the graph, then, is below the break-even point.

Stage 2: Profit Maximization

After developing a newly-defined, highly sought-after service, you are in high demand (Phase II). When your service is unique and new, you can charge whatever you want for it. This is the profit maximization phase, also called the innovative phase. This is where you would like to stay without any competition.

Stage 3: Price Competition

The third phase on the price lifecycle chart is the competitive phase. As IBM discovered with its line of personal computers (now defunct), your service “peaks” because competitors discover how to produce or provide your service/product and offer it at a lower price. Now you have to lower your 36 Chapter 2 price to keep up with them. This is the time to introduce a new product that has been brewing in Phase I. The traditional services that architects and engineers have offered for thousands of years all end up here.

Stage 4: The “Cutthroat” Phase

The fourth and final phase is the bidding or “cutthroat,” phase. In this phase, you try to stay competitive by bidding the lowest price. As you can be seen on the chart, this bidding phase is the least profitable place to be. To summarize a product lifecycle, a firm offering a brand-new service may actually lose money while learning how to sell it. But once it crosses the break-even line, the firm can sell this new service at an increasing fee until competition enters the market. As more and more competition enters the market, and as the new service becomes mature (traditional), both the potential fee and profitability decline.

So what has YOUR firm done to determine a client's future needs, and cement your position as a preferred partner?