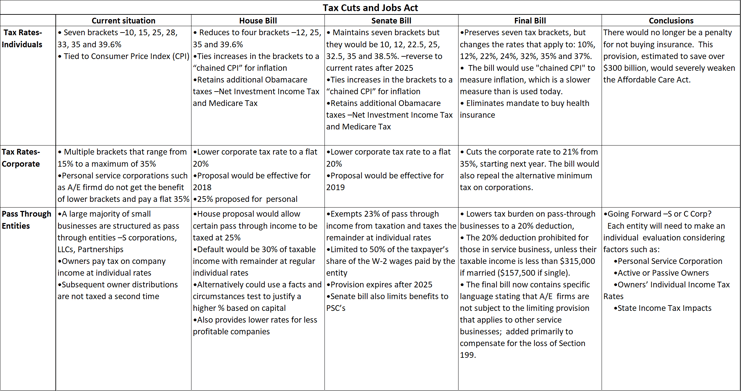

Congressional Republicans have now finalized the Tax Cuts and Jobs Act, new tax legislation that slashes the U.S. corporate tax rate to 21 percent and individual taxes for wealthy Americans to 37%. Also, Republicans approved a 20% income deduction for pass-throughs.

Congressional Republicans have now finalized the Tax Cuts and Jobs Act, new tax legislation that slashes the U.S. corporate tax rate to 21 percent and individual taxes for wealthy Americans to 37%. Also, Republicans approved a 20% income deduction for pass-throughs.

While specific service industries, such as health, law, and professional services are excluded, the final bill now contains specific language stating that A/E firms are not subject to the limiting provision on pass-through status that applies to other service businesses, a concession after industry lobbying, primarily added to compensate for the loss of Section 199.

Moreover, joint filers with income below $315,000 and other filers with income below $157,500 can claim the deduction fully on income from service industries. This provision would expire December 31, 2025.

The final bill also preserves the state and local tax deduction for anyone who itemizes, but caps the amount that can be deducted at $10,000. Also preserved are all personal deductions as they are under the current code. The final bill actually expands the medical expense deduction by the reducing threshold to 7.5% of income for 2018 and 2019. Other changes of note include the elimination of the mandate to buy health insurance, removing the penalty for not buying insurance.

There are several credits that have benefited the A/E/C industry including the Historic Tax Credit (HTC). The Senate bill kept the HTC though it eliminated the current 10 percent credit for pre-1936 structures and diluted the current 20 percent credit for certified historic structures by spreading it over a five-year period. The final bill both keeps the HTC and improves on the Senate bill's language by adding some flexibility for architects wishing to utilize the 20 percent credit.

Also most A/E projects qualify for the Research and Development Tax Credit. Focused on design activities, the credit allows 14 to 20 percent of Qualifying Research Expenditures, including wages, supplies, and subcontractors. While retained in the final bill, it can no longer be immediately deducted, but would need to be written off gradually.

Both the PSMJ newsletter and last week's blog post Uncertainty Reigns as Congress Settles Tax Reformprovided information comparing the House and Senate proposals. PSMJ now offers a complimentary download of a complete chart detailing how the new tax bill will affect the A/E industry moving forward.