The House approved its version of the Tax Cuts and Jobs Act on Nov. 16, and the Senate on Dec. 2, 2017, and were in conference to reconcile differences between the two bills.

“It is an understatement to say uncertainty reigns,” commented Tom Moul, Director of Strategic Tax Advisory Services, Stambaugh Ness in a Dec. 8, 2017 webinar Making Sense of Out of Tax Reform and It’s Industry Impact.

There are certainly similarities in two versions of the Tax Cuts and Jobs Act, “but there are significant differences that may have a significant impact on A/E businesses as well as firm owners,” Moul said.

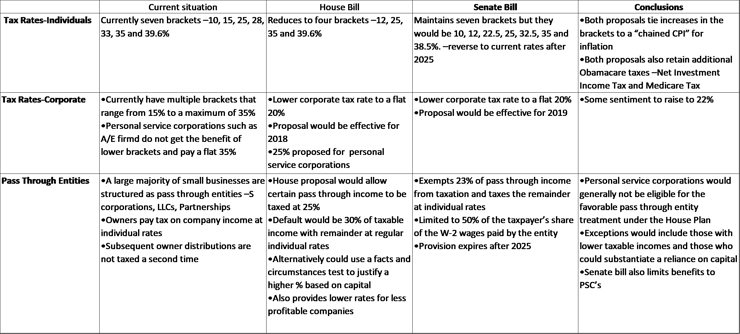

“Both bills project lower rates at both individual and corporate level, which all tax payers are happy about, but there are tradeoffs, some deductions and tax credits we’ve gotten used to over the years that are either modified or eliminated entirely,” he added (See chart below, which summarizes tax rate comparison information from Stambaugh Ness.).

Pass Through Blues

Specific provisions of the tax reform bill that impact A/E firms include tax rates for small businesses that operate as pass-through entities (See chart above).

Most A/E firms are pass-through entities, a hybrid between a corporation and an individual, Moul explains. In these structures, the owner pays company income at individual rates. “While there are some low brackets of individuals, there are brackets that are much higher than the 20 percent corporate rate, so there is a disparity here,” he says.

Recognizing the importance of the pass-through entity, both the House and Senate have made provisions for the pass-through entity, yet both bills continue to exclude A/E firms organized as “pass-through” companies from benefitting from reduced tax rates.

“Personal service corporations (PSCs) would generally not be eligible for the favorable pass through entity treatment under the House plan,” Moul says. “Exceptions would include those with lower taxable incomes, and those who could substantiate a reliance on capital.” The Senate bill also limits benefits to PSC’s.

A/E industry groups, such as ACEC and AIA, are lobbying Congress, asking why are they continue to treat knowledge-based industries differently from capital-based industries. According to the ACEC, in contrast to other "specified services" industries such as law, accounting and financial services, engineering and architecture are the only industries that (a) lose a significant tax benefit (Section 199) and (b) are excluded from the proposed pass-through tax benefits, resulting in a net tax increase. The explicit inclusion of A/E firms in the Section 199 deduction evidences recognition of the close connection of these firms to capital investment associated with infrastructure and other capital-intensive projects.

Getting Credit

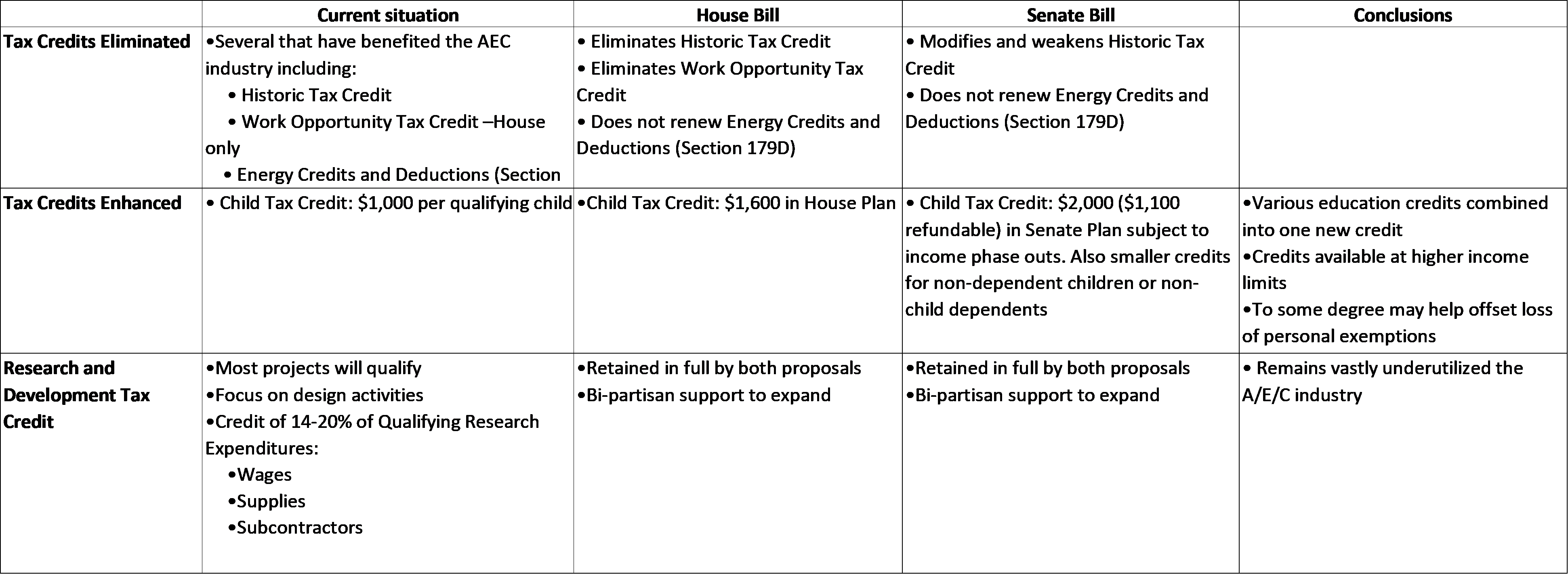

Another provision of the tax reform bill that impacts A/E firms is the Historic Preservation Tax Credit (HTC). House legislation completely abolishes the Historic Preservation Tax Credit (HTC) and the Senate version retains the provision, but significantly dilutes its effectiveness and usefulness. Another credit that A/E firms take advantage of, and which neither House or Senate plan to renew, is the Energy Credits and Deductions (Section 179D). (See chart below, which summarizes tax credit comparison information from Stambaugh Ness.)

One credit that A/E firms can still take advantage of is the Research and Development Tax Credit, which both House and Senate have renewed, and currently is underutilized by the industry.

Congressional Republicans have now reached a deal on final tax legislation, clearing the way on Dec. 13 for final votes on a package that would slash the U.S. corporate tax rate to 21 percent and individual taxes for wealthy Americans to 37%. Also, Republicans are now considering a 20% income deduction for pass-throughs, lower than the 23% deduction in the Senate bill. The bill also would include some version of House language letting pass-through firms qualify for a tax break based on their capital investment, the Wall Street Journal reports.

“At the end of the day,” Moul says, “it will come down to looking at your own circumstance, and how this tax bill affects you specifically.” He suggests that when the dust settles A/E firms engage in tax planning to take advantage of current tax laws before they are eliminated as well as to maximize their tax strategy for 2018.

To listen to the complimentary PSMJ/Stambaugh Ness webinar:

PSMJ now offers a complimentary download of a complete chart detailing how the new tax bill will affect the A/E industry moving forward.