While projections for this quarter in our previous Quarterly Market Forecast report indicated strong expected growth, actual growth rates were improved but well below expectations. Thus, it appears that many A/E firm leaders have higher hopes than reality produced.

Since 2003, PSMJ has been conducting surveys to assess the strength of all the major A/E/C markets. These surveys are conducted during the months of March, June, September, and December. In the surveys, we ask the following questions comparing the current quarter to the previous quarter:

-

Did your firm’s revenues increase or decrease? If so, were the increases/decreases more than 5% or less than 5%?

-

Did your firm’s backlog increase or decrease? If so, were the increases/decreases more than 5% or less than 5%?

-

Did the number of proposal opportunities increase or decrease?

-

What are your expectations for next quarter’s revenues? Do you expect them to increase or decrease? By more than 5% or less than 5%?

We also ask questions about the respondents’ markets, submarkets, and geographic regions. For the quarter ending September 30, 2015, we had over 250 participants in our Quarterly Market Forecast survey. We believe this presents a valid picture of current conditions in the most common A/E markets.

Slow but sure path to growth

Nationally, a slowdown in economic growth was noted in the first quarter in both the construction sector and the overall economy. The second quarter data indicates improvement from the first quarter, but as yet, we were not fully out of the recession. The third quarter appears to be another weak growth period, potentially slower than the second quarter.

Although slower than expected, the overall trends were still positive - just at the slow rate of growth that has become the hallmark of this recovery. Despite several years of recovery, construction volumes remain well below pre-recession levels.

There continue to be strong projections of revenue for the next quarter and proposals are also positive. Backlog was a small increase with more firms reporting increased backlogs this quarter. These indicators are positive for the rest of this year’s business climate.

They are not positive enough to signal a robust expansion, but continuing improvements across virtually all of our markets. We believe that, after the somewhat slower first quarter, this moderate increase of activity will continue to support continued recovery from the depressed levels of activity during the severe recession.

The hottest markets?

Based on the data collected for this report, the “hot” market segments represent the areas that have the highest portion of firms indicating that proposal activity is increasing.

More specifically, we have drilled into what specific submarkets appear to be showing the strongest proposal activity.

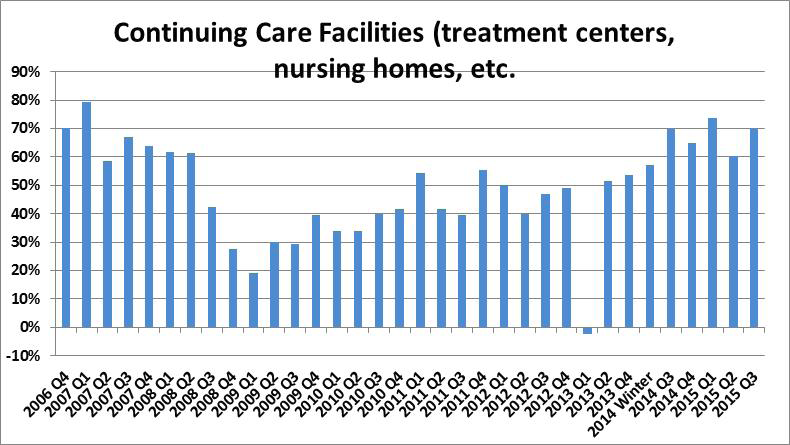

For this report, the “hottest” market segment was Continuing Care Facilities with 70% of repondents reporting increased proposal activity in that market.

Of course, many other markets are also reporting positive growth of proposals. For more detailed information, download a complimentary copy of PSMJ’s Quarterly Market Forecast.

About the Author: With thirty-five years of design industry experience as a manager, consultant and writer, William Fanning has helped numerous firms throughout the country improve profitability and firm management as well as transition firm ownership. Bill is the Director of Research for the Professional Services Management Journal (PSMJ), the largest newsletter devoted to the management of design firms.