In a just-released report, PSMJ presents the results of a study recently conducted on merger and acquisition (M&A) practices in the architecture and engineering (A/E) industry.

With a total of 122 participants, A/E Mergers & Acquisitions Study: How Today’s Most Successful Firms Grow Through Acquisition covers a variety of elements related to high-level M&A strategy as well as the nuts and bolts of putting together a successful transaction. It also covers how A/E firms are planning for future M&A opportunities: what their goals are as well as the elements of the M&A process they find the most challenging.

For the most accurate and representative M&A trends, the research on recent acquisitions is limited to participants that have completed at least one merger or acquisition in the past ten years. Additionally, all participants are strategic (as opposed to financial) acquirers. That means that they are all operating companies in the A/E space or in a related industry. None are solely financial investors.

According the study, a third of participants have made at least one merger or acquisition in the last 10 years.

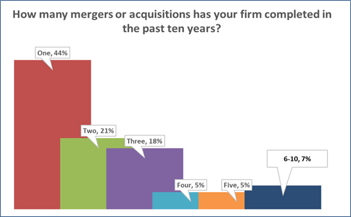

Of those firms that say they have completed a merger or acquisition, most (44 percent) have completed one transaction. Meanwhile, 21 percent have completed two mergers or acquisitions, 18 percent have completed three, and 17 percent have complete four or more.

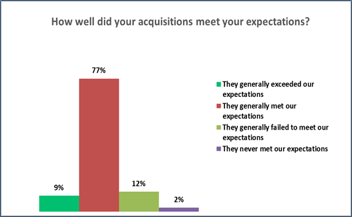

In this study, we were particularly interested in how successful acquirers believe their recent acquisitions have been.

In fact, more than three-quarters of firms that say they have completed a merger or acquisition report their acquisitions met their expectations. Yet, while 77 percent say they met their expectations, only nine percent say they exceeded their expectations. Meanwhile, 14 percent report that their acquisitions failed to meet expectations.

Furthermore, in this study we aim to determine how today’s most successful firms grow through acquisition. Consequently, we correlate how satisfied acquirers are with their transactions with a number of key factors such as firm size, ownership, relationship with acquired firm, reason for acquisition, transaction structure and terms, and much more. As the A/E industry evolves, we believe this is a valuable perspective to not only illustrate noteworthy trends but also to provide insight into what are the best practices for M&A success.

Finally, beyond just providing data and research, we strive to provide action-oriented advice around what to do with this information. And so, we wrap up with eight specific recommendations based on how the most successful firms can sustainably grow through acquisition.

Though we only cover a small corner of the vast world of mergers and acquisition in this study, we do hope you find it helpful.

Though we only cover a small corner of the vast world of mergers and acquisition in this study, we do hope you find it helpful.

PSMJ's A/E Mergers & Acquisitions Study is available for purchase or as a free download to PSMJ members.