Project managers are responsible for getting the project done and out the door... but does the work stop there?

Project managers are responsible for getting the project done and out the door... but does the work stop there?

A project isn’t successful until the money has been collected to pay for all that hard work and the costs incurred in the process. So what can you as a project manager do to impact collections?

-

Turn in your time sheet on time. Accounting generally cannot generate a draft invoice without knowing where your time was spent, so help them out. If you’re a Principal and you’re reading this… this means you, too.

-

Approve draft invoices so that accounting can bill the client. Do not leave projects unbilled once time has been posted to a time sheet. The costs associated with the time that has been posted go into an account called “work in process,” which means it’s essentially “on hold” and an invoice has not been created, so the firm cannot get paid.

-

Help with collections when appropriate. It’s easy to make accounting the “bad guy” if needed by calling the person you work with closely at the client and letting them know that accounting is really starting to put some pressure on you to get paid for all the hard work you’ve done on the project. A simple question is: Is there any way you can find out what the hold up is? This approach gives you the PM leverage to help the firm get paid.

-

Many times when a client isn’t paying it’s because they are unhappy—so do what you can to actively manage the relationship with the client, all along the way, to prevent this problem. Accounting can’t help you with this one.

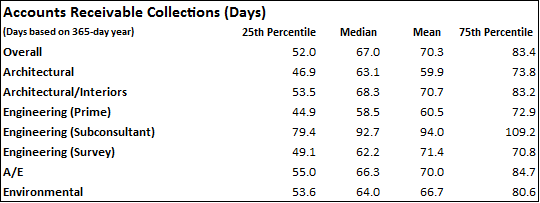

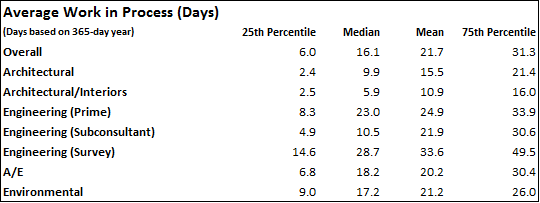

So what is a reasonable turnaround time? How fast is cash being collected in the industry today? To find out, check out the charts from PSMJ’s 2015 A/E Financial Performance Benchmark Survey Report below for Average Collection Days for Accounts Receivable and Unbilled Fees in Work in Process (Days).

How does your firm’s stack up against the competition? Where do you excel and where do you fall short compared to architecture or engineering firms of similar size, type or market sector served?

PSMJ’s 2016 Financial Performance Benchmark Survey Report puts the answers to these questions (and many more!) at your fingertips. No other product contains the detailed information that your architecture or engineering firm needs to thrive in today’s economy.

PSMJ’s 2016 Financial Performance Benchmark Survey Report puts the answers to these questions (and many more!) at your fingertips. No other product contains the detailed information that your architecture or engineering firm needs to thrive in today’s economy.

You also might be interested in these financial management related blog posts:

9 Ways to Assess Financial Risk on Projects

Benchmarking Your A/E Firm to Financial Growth

Data Dive: How Financial Performance Impacts Your Compensation Options