To drive your strategic growth planning, you need early stage data on not just the entire architecture and engineering (A/E) marketplace, but specifically on which markets are hot and which markets are not.

When market trends change (either positively or negatively), this is observed first as a change in the number of available proposal opportunities. These changes in proposal opportunities later become changes in backlog, revenues and cash flow.

Marketing spending, M&A investments, and strategic hiring all need this data (not guesses) to drive results. While data on overall construction activity and billings are helpful, these are actually lagging indicators because they refer to work already in-progress or completed.

PSMJ's latest Quarterly Market Forecast report tracks these indicators and presents them in a quarterly update.

“Time and time again, we hear from A/E firm leaders that our Quarterly Market Forecast data is their crystal ball into what lies ahead,” states Frank A. Stasiowski, FAIA, Founder and CEO of PSMJ Resources, Inc.

hear from A/E firm leaders that our Quarterly Market Forecast data is their crystal ball into what lies ahead,” states Frank A. Stasiowski, FAIA, Founder and CEO of PSMJ Resources, Inc.

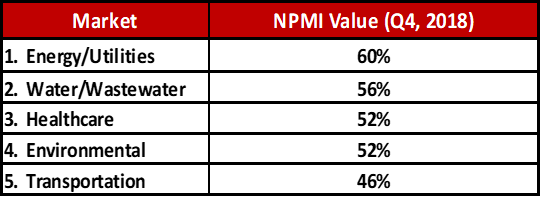

The data in the latest report was collected from A/E firm leaders asking their position, opinion, and outlook as of Q4, 2018. It also provides new data illustrating the current top five “hot” markets in terms of the highest Net Plus/Minus Index (NPMI) values on proposal activity. Increasing proposal activity generally indicates a good growth market, and thus the greatest opportunity for firms looking to grow.

Based on the data collected for this report, the “hot” market segments represent the areas that have the highest portion of firms indicating that proposal activity is increasing. More specifically, we have drilled into what specific submarkets appear to be showing the strongest proposal activity. For this Q4 report, the five “hottest” market segments are:

When reviewing this information, remember that many other markets are also reporting positive growth of proposals. This chart only reflects the five market segments with the strongest “net” proposal activity and thus the apparent high level of future projects.

For more detailed information, get a copy of PSMJ's Quarterly Market Forecast.