If your A/E/C firm is largely operating in the public sector, you may be rolling through some of the best market conditions we’ll see in our lifetimes. Local funding and allocation hiccups aside, the Federal government has the motivation and the funding to make big things happen in the infrastructure space. For some more good news, even some private-sector markets that seemed to be in a freefall as of late – like Housing – appear to have found a bottom and are starting to stabilize, according to data in PSMJ’s latest Quarterly Market Forecast. But, there is area where the hurt may be just beginning—the Commercial market.

“This is becoming a bit of a perfect storm for the Commercial Development and User markets. At first, corporate office oversupply in some of the major metropolitan markets seemed like a short-term post-COVID issue![]() .” states PSMJ President Gregory Hart. “However, the reality for a lot of owners and developers is that we’ll never go back to pre-COVID occupancy anytime soon and now we have the issue of commercial loans getting re-priced at interest rates much higher than they were at a few years ago. Don’t walk, run from any exposure you have in the corporate office market. If you need a safe haven in this overall space, the Warehouse/Distribution market has good proposal activity on which you can build some long-term strategic growth.”

.” states PSMJ President Gregory Hart. “However, the reality for a lot of owners and developers is that we’ll never go back to pre-COVID occupancy anytime soon and now we have the issue of commercial loans getting re-priced at interest rates much higher than they were at a few years ago. Don’t walk, run from any exposure you have in the corporate office market. If you need a safe haven in this overall space, the Warehouse/Distribution market has good proposal activity on which you can build some long-term strategic growth.”

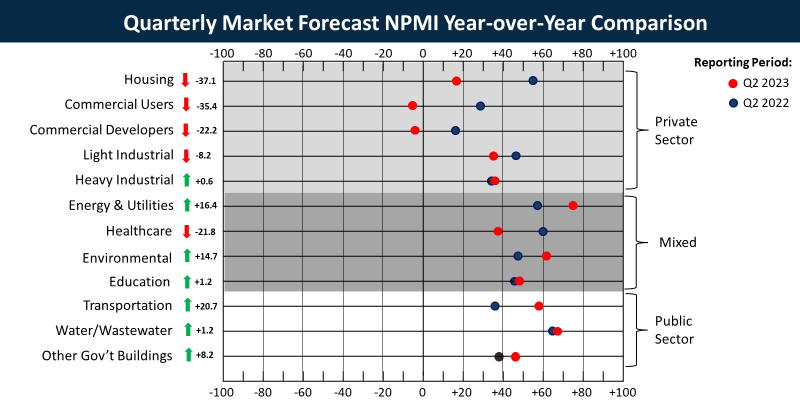

PSMJ’s latest Quarterly Market Forecast surveyed 183 A/E/C executives (collected between June 30, 2023 and July 7, 2023) and revealed an overall proposal activity Net Plus/Minus Index (NPMI) value of 24.9, which marks a slight dip from 32.8 in the previous quarter and 33.3 one year prior.

Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and—ultimately—cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12 to 24 months.

Based on our latest Quarterly Market Forecast data, the following summarize the five markets with the highest NPMI values:

Energy/Utilities 75.0

Water/Wastewater 66.7

Environmental 61.1

Transportation 59.2

Other Government Buildings 47.4

For actionable strategies and ideas for taking advantage of lucrative markets headed into 2024, don't miss PSMJ Senior Principal Dave Burstein's keynote address at our annual A/E/C THRIVE conference, coming September 20-22. Join your peers in Salt Lake City for three powerful days of networking, strategy, and fresh approaches to improved business and financial performance. Register now.