Read the Case Study below to learn how analyzing a few key metrics in your architecture or engineering firm’s income statement can give you immediate insight into problem areas so you can dig deeper and not waste valuable time!

Case Study of a 65-Person Firm in the A/E Industry

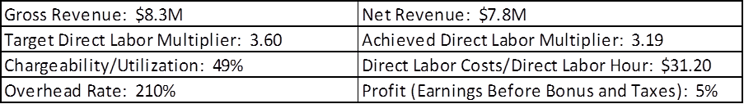

What does this mean at the 30,000 foot level? At first glance it appears the target and the achieved multipliers look pretty good! They are both above 3.0, which was the A/E industry average for decades – so what’s the problem? The overhead rate stands out at 210% and profit is very low at 5%. Overhead rates are calculated using direct labor costs so the breakeven multiplier for this firm is 3.10. An achieved multiplier of 3.19 barely covers the cost to run the firm, as evidenced by the low profitability. When a firm doesn’t achieve their target multiplier the first culprit is likely project overruns – but it may also be because fees are insufficient to support the scope or change orders are not being invoiced. Generally it’s a combination of these things!

Next we have a very high overhead rate of 210% – the industry median varies by firm type but overall it should be closer to 161% (top performing firms report about 145%). The culprit here is likely twofold: not enough billable work as evidenced by the low chargeability (industry median is 59%; top performers report 64%) and low net revenue per total staff of $120K (industry median is $135K); and/or they may be carrying more overhead positions than they can support. Generally, firms tend to closely monitor their non-labor overhead costs (rent, insurance, etc.) but labor allocated to indirect labor (overhead) changes from week to week and can get out of control very quickly if enough professional staff (principals, PMs, technical staff, etc.) are not charging to project work.

Outcome for this firm?

-

They had excess overhead staff with very high salaries – some of that staff was cut immediately.

-

They did not have a strong PM culture nor did they monitor project performance metrics (accountability) – so project management training and monitoring procedures were put in place.

-

The firm had to increase net revenue – look for low hanging fruit in existing markets, land work in new markets, or layoff professional/technical staff – they won more work and kept their staff.

Analyzing financials may seem like a daunting task and likely you are not overly excited about looking at what’s not working – but with a few metrics you can quickly find the problem area and use your resources to dig deeper and diagnose the cause! Stop the bleeding! This firm quickly turned things around and had a great year!