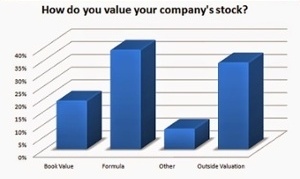

A PSMJ A/E Pulse poll shows that more than 1/3 of architecture/engineering (A/E) firms (a full 39%) use a formula to determine their stock price. A ‘formula’ can defined as some sort of mathematical equation to calculate the value at a given point in time.

A PSMJ A/E Pulse poll shows that more than 1/3 of architecture/engineering (A/E) firms (a full 39%) use a formula to determine their stock price. A ‘formula’ can defined as some sort of mathematical equation to calculate the value at a given point in time.

Over the years, I’ve seen it all when it comes to valuation formulas…from the real basic and simple ones to the extremely complex ones. Some yield a value that is quite close to the actual fair market value of the stock and some are just way off.

If you are using a formula to set your stock price, here are some tips to make sure that it is behaving as it should be:

1. Keep it simple. A valuation formula should be easy to calculate and difficult to manipulate. Don’t start trying to factor in external things like consumer price indices or other economic metrics. Of course, there are external economic and market factors that can raise and lower valuations across the board over time. But, I’ve yet to see a formula that can accurately capture this. Focus on simple metrics like revenue, earnings, and balance sheet strength in your formula.

2. Give it a check. To my point above about external economic and market factors, no valuation formula should go unchecked for more than three or four years. The A/E industry is heavily exposed to boom and bust cycles. Benchmarking your valuation formula with an outside professional valuation every few years will confirm whether the formula is still yielding reasonable results or if it needs to be recalibrated.

3. Know the basis. The actual value of an A/E firm’s equity is highly dependent on the purpose of a valuation. Generally speaking, an internal share transfer valuation will almost always be significantly lower than an external sale valuation. Know exactly which basis of value your formula is designed for and use it only for that purpose.

One parting point of note. The A/E Pulse data also shows that 19% of the firms surveyed are setting their stock price at book value. I’m out of space here, but I certainly want to point out some pros and cons of this approach in a future article. As a quick teaser, I’ll just point out that book value is a metric that is fairly easy to calculate. But, the downside is that it can grossly undervalue a design firm. More to come on that topic!

About the Author: As a consultant with PSMJ, Greg Hart advises clients primarily in the areas of mergers & acquisitions, ownership succession planning, and business valuation. He has personally worked with dozens of architecture, engineering, and environmental consulting firms on these matters. Additionally, Greg frequently contributes to a range of PSMJ and industry publications, and speaks to various audiences on topics such as M&A strategy and succession planning.

For 40 years, PSMJ has worked with A/E firms of all shapes and sizes (and helped fix many valuations gone awry). PSMJ now introduces the A/E industry’s most definitive valuation survey available anywhere. As indicated in this infographic, PSMJ's 2015 Valuation Survey contains equity valuation multiples based on:

- Revenue

- Earnings

- Book Value

- and more