As an architect and/or engineer, do you work on projects that require you to go through a technological, iterative process to come up with a final and appropriate design? Of course you do! That’s what architects and engineers refer to as design and engineering, and what the U.S. tax code refers to as research and development (R&D).

1. Perform Research & Development Activities!

Example activities and innovations eligible for R&D tax credits:

-

Designing master plans

-

Schematic design, design development, and construction documents

-

Developing building elevations

-

Pursuing LEED certification

-

Designing HVAC, electrical, and plumbing systems

-

AV/IT/Fire/Security Design

-

Structural engineering

-

CAD & BIM modeling

-

Civil engineering

-

Hydrology and hydraulic modeling & analysis

-

Transportation and traffic engineering and design

-

Environmental impact studies

-

Geotechnical engineering

It seems counterintuitive that these activities would be considered R&D, especially on “routine” projects, but through some education on Section 41 of the tax code, its associated regulations, and applicable case law, it becomes very clear how applicable R&D Tax Credits are to architects, engineers, and even construction companies.

2. Produce Contemporaneous Documentation

The R&D tax credit is in large part based on the amount of money a company spends on R&D activities (referred to as Qualified Research Expenses). For most architecture and engineering (A/E) firms, the majority of these expenses comes from wages paid to employees for performing R&D activities. In order to substantiate the credits, contemporaneous documentation is reviewed to verify projects and activities and establish nexus between activity and expense.

The great news is that the A/E industry is the gold standard in contemporaneous documentation. Most companies require employees to use time tracking, which in turn allows companies to substantiate how much time employees are spending on the types of projects and activities that qualify as R&D under the tax code. Also, most A&E firms are producing documents such as drawings and technical reports that further establish the nexus between activity and expense.

3. Retain Substantial Rights in the Research

Most A/E firms are working on projects under contract for clients. Contracts should be reviewed to ensure the company retains rights to their work. Rights need not be exclusive (a right to use the results of research in the taxpayer / contractor’s business is sufficient). If not expressly stated, there are typically implied rights.

It is very typical for clients to retain ownership of construction documents and studies created under contract. However, the client typically only has the right to use such documents solely in connection with the specific projects for which the documents were created. Unless explicitly stated otherwise, the A/E firm retains the rights to the research developed in the evaluation, testing, planning, design, and construction process under such contracts.

4. Bear Economic Risk of Loss

For work under contract, A/E firms must show that payment under the agreement is contingent on the success of the research. The taxpayer must bear the expense even if research is unsuccessful. Some key contract provisions affecting risk of loss:

-

Scope

-

Final & provisional acceptance of work

-

Fees

-

Warranties

-

Remedies

-

Payment terms

-

Termination

Most contracts with payment terms based on stipulated price, lump sum, fixed fee, unit price, or percentage of construction costs are generally considered for evaluation of R&D.

5. Find a Tax Consultant to Give You an Assessment

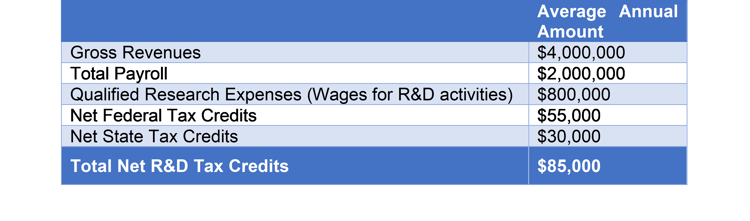

How much are these tax credits worth? Let’s look at a simple case study for an architecture firm in California that designs small retail and office buildings with less than 50 employees:

Given the expansive scope of eligible activities and potential size of tax savings, all architecture and engineering firms are excellent candidates for R&D Tax Credits and should at least consider an assessment by a qualified professional. While including your tax accountant is important, as a specialty tax incentive, you should also consider obtaining an assessment from a specialty tax service provider, like BRAYN, to help vet these opportunities.

See more about specialty tax credits and incentives for the A&E industry here or subscribe to BRAYN’s YouTube channel.

About the Author: Kevin Sullivan, P.E., LEED AP is the Director of Construction & Real Estate Tax Incentives at BRAYN. His mission is to leverage his 15 years of experience in the design and construction industry to help CPA’s and their clients take full advantage of all federal and state tax incentives, credits, and deductions available to them. He is an award-winning expert on sustainable design and construction, and licensed as a Professional Engineer in over 30 states. You can contact Kevin Sullivan at kevin@braynconsulting.com or directly at 832-570-3112.

BRAYN Consulting is a sponsor and exhibitor of PSMJ's annual conference to held October 22-24 in San Diego. THRIVE 2018 is your chance to learn, to network, and to get an eye-opening perspective on what the world’s most successful architecture and engineering firms are doing right now to thrive. This unique annual conference attracts senior-level executives from a wide range of A/E/C organizations located around the world.