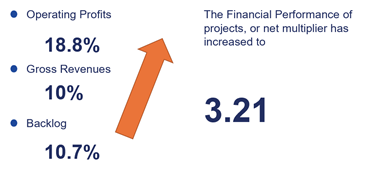

Yes, 2018 was a great year for architecture and engineering firms and the results from PSMJ's 2019 A/E Financial Performance Benchmark Survey

Yes, 2018 was a great year for architecture and engineering firms and the results from PSMJ's 2019 A/E Financial Performance Benchmark Survey

tell the story.

The A/E industry has seen these good times as recent as 2007, only to see the metrics fall dramatically in 2010. As 2007 sits in the back of our minds, we continue to grow our businesses, specifically the median size of our staff, which has grown 5.1% from 2018.

What is to come in 2020 and beyond? What challenges does your firm have? What metrics are most important to your business? How will you continue to thrive when growth starts to slow?

Maintaining profit margins today and in the future in a competitive marketplace is increasingly more difficult as the cost to hire and retain talent continues to rise.

Imagine if your firm could recoup some of these costs on an annual basis. The Research & Development (R&D) Tax credit allows you to do just that. The activities you perform as architects and engineers typically qualifies for an annual federal R&D tax credit, and an additional credit in dozens of states, of up to 9% of qualified R&D expenses.

Why have you not heard about the R&D credit or not taken full advantage of it? There could be plenty of reasons for that; lack of exposure, taxes are not your expertise, your CPA is not familiar with this more complex credit, or you just don’t feel the time to claim the credit is worth it.

How much time and energy does it take to generate a profitable $30,000 or $50,000 project? 100 hours? 200? The highest margin project you complete this year could be your R&D tax credit study. BRAYN’s AE clients average over $1,500 in federal tax credits and almost $1,500 in state credits (in the states that have a program) per employee. And our clients spend an average of 20 hours per year on these studies. So, a typical AE firm of 25 people will spend less than 20 hours to generate over $50,000 in federal and state credits.

If you are currently taking the R&D credit, you are aware of the many benefits to an R&D study:

-

Substantial annual tax credit that can work for all entity structures

- Flow through for principal owners on S-Corp, Partnerships

- Even ESOPs can take advantage of R&D credits if they are in a state that has a program

-

Easier to complete over time, less time and effort of staff

-

The tax credit doesn’t come with any A/R bad debt

-

No costs for sales or business development

-

Aid in cleaning up data for consistency and detail

- Leverage your time tracking for cleaner data

It’s time to recoup the dollars you spend on R&D and maximize the earning potential of your firm!

BRAYN is a team of in-house lawyers, accountants and engineers that offer FREE Phase 1 assessments to estimate your R&D tax credit and provide you a scope of work and competitive fixed fee to help you claim the incentive and grow your business. 100% of our audited studies have been successfully defended since we opened for business in 2010, and we have never had a credit or deduction denied under audit. We work with your CPA to provide the R&D calculation and documentation for this tax opportunity and stand by everything we do.

Reach out to BRAYN for a FREE Phase 1 assessment for a R&D Tax Credit Study.

About the Authors: Jason Villere is Director and Kevin Sullivan is a Partner at BRAYN Consulting LLC.

BRAYN Consulting LLC. is a sponsor and exhibitor at A/E/C THRIVE 2019: The Growth, Profit, and Success Summit for A/E/C Firm Leaders taking

BRAYN Consulting LLC. is a sponsor and exhibitor at A/E/C THRIVE 2019: The Growth, Profit, and Success Summit for A/E/C Firm Leaders taking

place October 2-4, 2019, in New Orleans, LA.

This unique conference is an opportunity to hear directly from the leaders of top-performing firms and other industry visionaries on specific growth, profit, and performance improvement practices and how to replicate them.